Making Reference-Dependent Preferences: Evidence from Door-to-Door Sales

Abstract

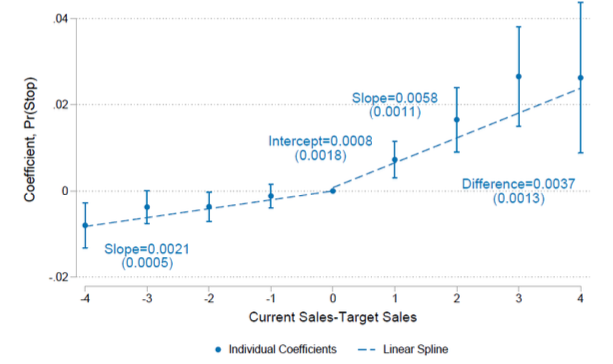

This paper uses data from a door-to-door sales company and an online experiment to examine the relationship between reference-dependent daily labor supply and long-run goal achievement. In the sales data, I show that daily labor supply kinks downward at a worker’s expectations and that these expectations directly correspond to bonuses paid at the end of the sales season. The bonuses induce workers to adopt long-run targets and subsequently distribute these into internalized daily goals around which they exhibit loss aversion. These dynamics explain why non-linear payment schemes increase performance: workers change their short-run behavior in response to long-run performance targets. The online experiment confirms a causal interpretation of this relationship between bonuses and short-run behavior and supports the idea that short-run reference dependence can be `made’ or induced by firms by adopting non-linear compensation schemes. These dynamics increase worker output and firm profitability and can explain why non-linear compensation is so popular in the labor market.