Seniors' Home Equity Extraction: Credit Constraints and Borrowing Channels

Abstract

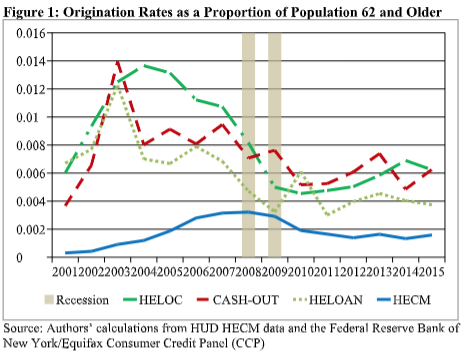

Households borrow against home equity through different types of mortgages: closed end home equity loans or revolving lines of credit, cash-out refinancing, and—for senior homeowners—reverse mortgages. The objective of this study is to identify how borrowing constraints and the lending environment affect the rate of seniors’ home equity borrowing and their choice of mortgage product. Ours is the first study to model the choice of reverse mortgages alongside other modes of equity borrowing. During the house price boom (2001-2007), we find that credit constrained areas display higher rates of home equity borrowing than less constrained areas as home equity levels increase for cash-out refinancing and reverse mortgages. During the recovery period (2010-2015), we observe this relationship only for reverse mortgage borrowing, consistent with tightened underwriting for forward mortgage loans.