Insurance Subsidies, the Affordable Care Act, and Financial Stability | Journal of Policy Analysis and Management

Abstract

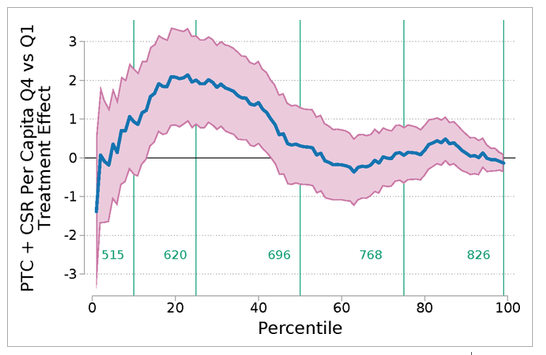

This paper measures the effects of subsidies in the Affordable Care Act on adverse financial outcomes using administrative tax data and credit data on financial outcomes. Using a difference-in-differences design with propensity score reweighting, I find that at $100 per capita, ACA premium tax credits and cost-sharing reduction subsidies reduced consumer bankruptcies and severe auto delinquency by 8 percent and 7 percent, respectively, and substantially reduced right-tail delinquent debt and third-party collections. The value of recipients’ risk protection against medical debt payments amounts to approximately 16 to 21 percent of the cash costs of the subsidies, while the subsidies provided substantial indirect transfers to external parties. NEW: AI-generated podcast summary