Insurance Subsidies, the Affordable Care Act, and Financial Stability

Abstract

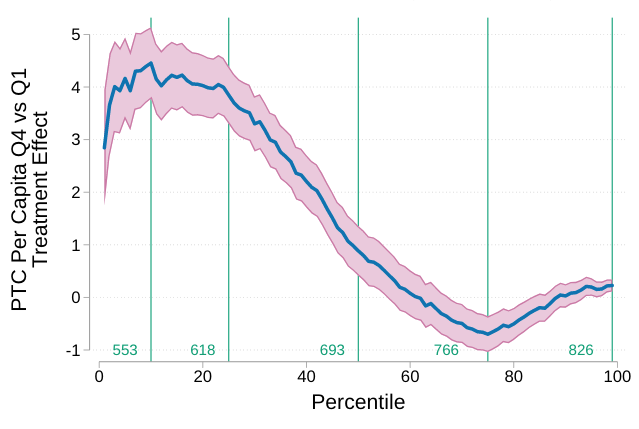

This paper measures the effects of subsidies in the Affordable Care Act on adverse financial outcomes using administrative tax data and financial outcomes from credit data. Using a difference-in-differences design with propensity score stratification, I find that at $100 per capita, ACA premium tax credits reduced the rate of severe mortgage delinquency by 4%, consumer bankruptcies by 13%, and the rate of severe auto delinquency by 13%. The subsidies reduced the right tail of the debt distribution, including debts in third-party collections. The benefits of the tax credits accrue to a variety of economic actors. The value of the risk protections to recipients against medical debt amounts to approximately 10-15% of the cash costs of the credits, while the subsidies provided substantial indirect transfers to external parties totaling approximately two-thirds of the program’s costs.