Abstract

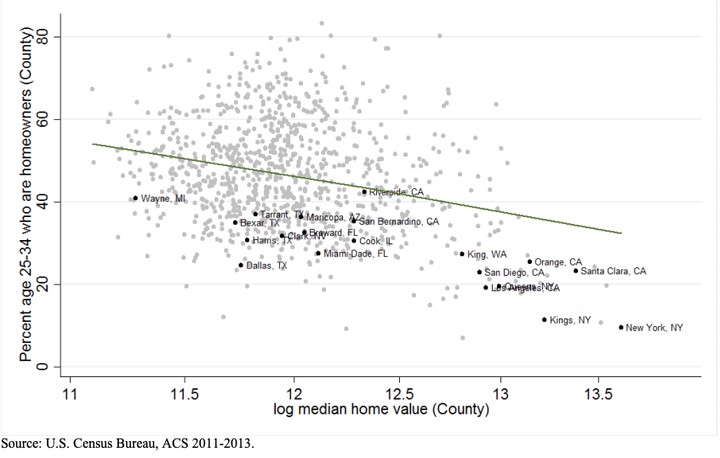

As the U.S. emerges from the Great Recession, there is concern about slowing rates of new household formation and declining interest in homeownership, especially among younger households. Potential reasons that have been posited include tight mortgage credit and housing supply, changing preferences over tenure in the wake of the foreclosure crisis, and weak labor markets for young workers. In this paper, we examine how individual housing choices, and the stated motivations for these choices, reflect local housing affordability and individual financial circumstances, focusing particularly on young households. The analysis makes use of new individual-level data from the Survey of Household Economics and Decisionmaking (SHED). We find that housing affordability is correlated with county-level tenure rates and individuallevel probability of homeownership for households with heads under age 40. However, it appears that young households’ perceived barriers to homeownership are more closely related to individual financial circumstances than local housing market conditions.